So, my friends, what we need are forward-thinking initiatives at the national level to triple the number of African-American owned businesses.

Everyone in this room is working to make that happen, and I have some ideas on how we can do more. First of all, we need to work together to tackle the “wealth gap.� When a white family’s net worth is $67,000 but a black family’s is only $6,100, we have a real problem in this country. Frederick Douglass once said, “power concedes nothing without a demand. It never did and it never will.�

(Kerry, right, says we have a long way to go in empowering Black businesses).

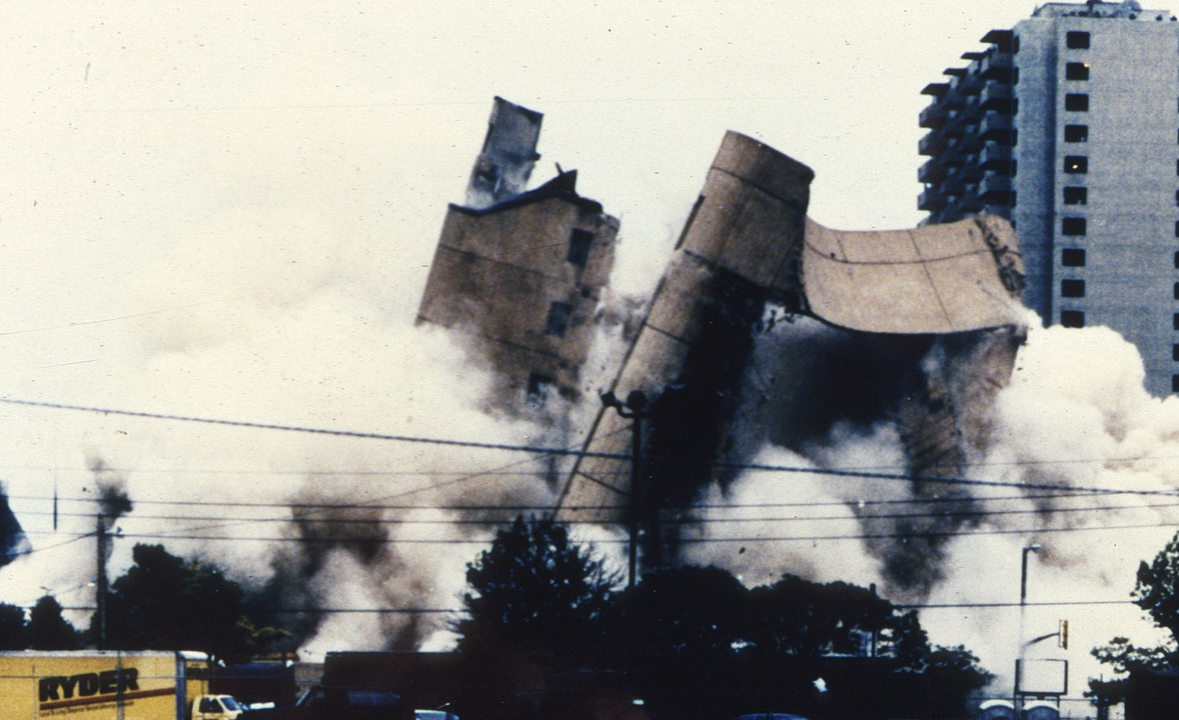

Economic opportunity for everyone is also a civil right. This is my third trip to Louisiana since Hurricane Katrina struck the Gulf Coast last summer. When I came here in May with Senator Mary Landrieu, I toured parts of New Orleans that, frankly, still look like the third world.

Katrina pulled back the curtain and revealed a reality of poverty and desperation that many thought no longer existed in our country. It’s astounding. Here we are, in the richest country in the world, and nearly one year after a devastating storm, our people are still waiting for help from the federal government to pick up the pieces and rebuild. Amazingly, tragically, just like during the storm, the people of New Orleans are once again waiting for the help from Washington that they’ve been promised.

To those of you who own businesses and work here in the Gulf, I applaud your perseverance, your courage, and your determination to rebuild in the face of adversity. It’s time for America to do right by New Orleans.

What’s the hold up? We can’t blame ‘heck of a job’ Brownie, the former FEMA director, anymore — he’s gone. We can’t blame Hector Barreto, the former head of the Small Business Administration, because he just jumped ship too. Where can the people of the Gulf turn?

On September 15th, President Bush stood in Jackson Square and made promises. He promised to ‘do what it takes,’ to ‘stay as long as it takes’ to help citizens rebuild their lives and communities. The President said that ‘when the streets are rebuilt, there should be many new businesses, including minority-owned businesses, along those streets.’ Those are his own words. But the people I’ve met in New Orleans say these promises have been broken. And, after witnessing it with my own eyes, so do I.

It’s been 10 months since the President made those promises. More than $10 billion in contracts have been awarded for debris removal, yet piles of debris, street after street, remain in New Orleans East, where I toured in May.

From all of your stories, I hear that the people of New Orleans are still going through hard times, that only half of the hospitals are open, and one-fifth of the schools and childcare centers, one-sixth of the transportation system, and—in a city that loves its food like no other—less than half the restaurants have reopened. We’re spending American taxpayers’ dollars a lot faster on rebuilding Iraq than on rebuilding New Orleans.

According to the U.S. Chamber of Commerce, 125,000 small and medium-sized businesses were disrupted or destroyed by hurricanes Katrina, Rita and Wilma along the Gulf Coast.

I’ve been working closely with your own Sen. Mary Landrieu on a plan to help get the Gulf Coast back in business. In fact, we put together bipartisan legislation in the Senate back in September. It passed, but guess what? The Bush Administration is blocking it. They said, “no can do.� So Sen. Landrieu and I introduced another bill to give impacted Gulf Coast states $50 million for emergency bridge loans to those that need money immediately.

Today, although more than $10 billion of SBA disaster loans have been approved, less than $2 billion has made it into the hands of Gulf Coast residents to rebuild their communities. Non-profit groups — from schools to churches — should also be able to get disaster loans too. And to help Gulf Coast residents get their feet under them, we should extend the loan deadline.

Sadly, we had to learn some tough lessons from the 2005 hurricanes. But now is the time to turn these lessons into action and solutions. Just this month, the new SBA chief, Steven Preston, was sworn in to take over this agency. The SBA is the only federal agency that is charged with looking out for you, the small, minority-, women-, and veteran-owned firms across the country. I’m not talking about hand-outs; I’m talking about a helping hand that levels the playing field instead of putting big business first.

We need an SBA chief who is a champion for small businesses. Someone who will not endorse big business policies that hurt small firms, who will fight to fund key small business programs. And—this is important– we need someone who will stand up for minority firms and minority entrepreneurs, not leave them behind.

Today, there are well over one million black business owners. Which sounds great, until you consider that last year African Americans accounted for 12.3 percent of the U.S. population, but only four percent of all businesses in the country. So, my friends, what we need are forward-thinking initiatives at the national level to triple the number of African-American owned businesses.

Everyone in this room is working to make that happen, and I have some ideas on how we can do more. First of all, we need to work together to tackle the “wealth gap.� When a white family’s net worth is $67,000 but a black family’s is only $6,100, we have a real problem in this country.

That’s why I have been working with leaders in the business and higher education communities – especially in underserved areas including Historically Black Colleges and Universities, Hispanic Serving Institutions, and Tribal colleges to encourage entrepreneurship and help minority firms get the tools they need. I introduced legislation to create a grant program aimed at these minority institutions to help target students in highly-skilled fields and guide them towards starting a business as a career option.

I’ve also introduced legislation to give minority small business owners an advocate in the SBA by creating an Office of Minority Small Business Development. Frankly, I don’t think the Bush Administration is doing enough to ensure minority firms are able to remain innovative and competitive. Too many minorities are still financing their businesses on credit cards and too many fear unfair denial from lenders. That shouldn’t be the case. They deserve a fair chance and the knowledge that the SBA’s lending partners can help them thrive and boost our economy.

For everyone, access to capital remains one of the top obstacles to starting and growing a small business in this country. Especially for minorities. Over the last five years the SBA’s two biggest loan programs — 7(a) and 504 — have not done their job. Lending to African Americans – dollar for dollar – is stagnant compared to the rest of the population where there have been strong increases.

All of these bills – my minority entrepreneurship program and the small business lending improvement proposals that establish a minority business advocate – have received the support of the National Black Chamber of Commerce. I thank you for your support. And I call on you to help me turn these proposals into a reality that expands the economic empowerment of African American communities all across the nation.

The Senate Committee on Small Business and Entrepreneurship – on which I’ve served for more than 20 years – is working to pass a large piece of small business legislation next week. I’ve been fighting to include the Minority Entrepreneurship bill, which is my top priority, but I have definitely encountered resistance. Frederick Douglass once said, “power concedes nothing without a demand. It never did and it never will.�

And I’ve also collaborated with my Senate colleagues, Barack Obama and Bill Nelson, to get the Federal Communications Commission to stand up for small business in the media, including minority-owned newspapers and broadcast stations. Media consolidation is making it harder for everyone to compete against the giants in the industry, especially for small businesses, minorities and women. Ownership of our media voices should reflect the diversity of our country, not defy it.

Hurricane Katrina stripped away any illusions we might have had about the reliability of this administration to respond to a crisis. It showed us just how little compassion goes into compassionate conservatism, and New Orleans deserves better. We can return to the core principles of this nation and we can help all of America’s entrepreneurs – black and white, large and small—to succeed and prosper.

(Excerpted from Senator Kerry’s July 21 remarks to the National Black Chamber of Commerce, 14th Annual Convention, New Orleans, Louisiana.)

To subscribe to or advertise in New York’s leading Pan African weekly investigative newspaper, please call (212) 481-7745 or send a note to [email protected] Send newstips to [email protected]

Aw, this was a really nice post. In thought I wish to put in writing like this moreover – taking time and precise effort to make a very good article… however what can I say… I procrastinate alot and in no way seem to get something done.