Now, given his failure to save his friend Sulzberger’s media company, would you entrust Rattner with the fortunes of the auto industry? The past is prolog to the future.

[Genesis Of Financial Meltdown: Auto Industry]

Steven Rattner is consigliore, or counselor, to Treasury Secretary Timothy Geithner and is leading the task force which is supposed to advise President Obama on how to fix the car industry.

Steven Rattner is a force to be reckoned- a typhoon, or big wind. Rattner began his career as a reporter for the New York Times. Later he became a favorite of New York Times publisher Arthur “Pinch” Sulzberger.

After leaving The Times, Rattner went into private finance and eventually was one of the founding partners of the Quadrangle Group, a private equity firm that specialized in media properties. As such, Rattner is advising New York City Mayor Michael Bloomberg on Bloomberg’s holdings.

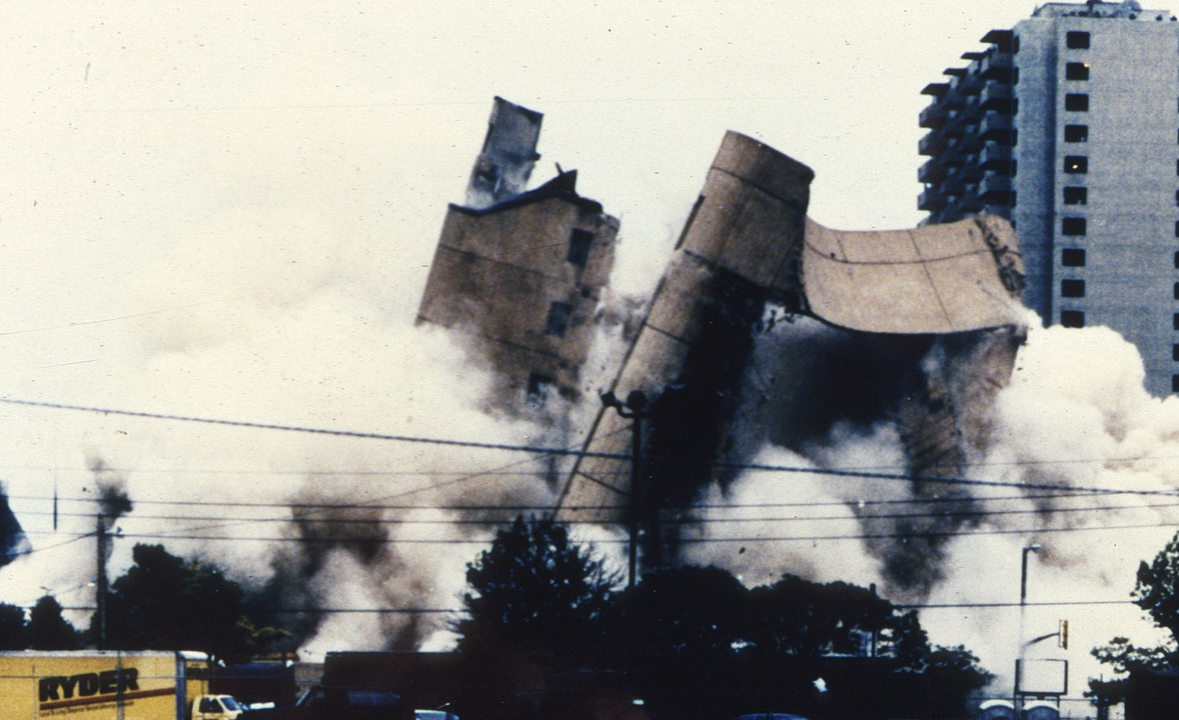

Last week, Rick Wagoner, Chief Executive of General Motors Corp., was forced to resign. Wagoner believed in big cars and this has been alleged to have been the downfall of General Motors. Even more astounding GM, that bastion of American efficiency and power, has reported losses totaling $82 billion since 2004.

GM accomplished this feat by producing huge gasoline-guzzling SUVs and trucks, which no one purchased when gasoline prices were $4 per gallon. Small energy saving cars have been lauded as the future- even though small energy efficient cars are not selling in the era of $2 per gallon gasoline.

Wagoner obviously was not the man to lead GM into the future. In an industry that needs vision and financial competence, Wagoner woefully lacked both. It appears that President Obama believes that Rattner is some sort of Magi, an individual who can portend important events.

But that is not the correct perception of Rattner.

There is an interesting side to Rattner, which has not been discussed. Rattner was a big supporter of Hillary Clinton’s presidential bid. Rattner was so self-consumed that he believed that he would be Treasury Secretary in a Clinton Administration-although, I do not know what qualifications Rattner possesses that would make him a suitable Treasury Secretary, other than an oversized ego, big contributions to Hillary Clinton’s presidential campaign, and a fast friendship with the Sulzbergers; his advice has led to disaster for the shareholders of The New York Times.

Let me elaborate on The Times situation. Hassan Elmasry was a fund manager at Morgan Stanley. His fund had purchased shares of The New York Times. In 2006 and 2007, Elmasry was not happy with the stock price of The New York Times schussing downward like the great Jean Claude Killy, the Frenchman who shocked the world at the 1968 Winter Olympics, by winning three gold medals in skiing competition. So, Elmasry made several recommendations to help prop up the price of the stock; he asked to meet with Sulzberger and was promptly rejected. He offloaded the stocks; he smartly cut his losses.

Pinch Sulzberger looked in the mirror and saw what he liked most; himself. He has had his defining business moments, such as his disinclination to invest in Google; or his refusal to make a deal with Amazon; or his refusal in 2003 to sell The Boston Globe for $500 million to an investor group that was headed by Jack Welch—now he is actually considering shutting the Globe down. The paper is on course to lose $85 million.

Who has been Sulzberger’s consigliore all this time? Yes, the one and only, Steve Rattner. The Magi with deep insight into the movement of the stars who provided Sulzberger with sagacious advice.

Here’s the advice that I actually gave Sulzberger in two letters in 2006 and 2007. On November 30, 2006 I wrote to Deloitte & Touche, the public auditors of The New York Times, and to Sulzberger, stating: “The New York Times must take a write off of $600 million of the purchase price of The Boston Globe. This is mandated by Sarbanes-Oxley and Generally Accepted Accounting Principles.” Guess what? Two months later The Times announced an even larger write-off of its newspaper assets, including The Boston Globe; the Times had finally realized that the newspaper business was in rapid decline.

On December 16, 2007 I wrote to Kenneth Richieri, Executive Vice President and General Counsel of The New York Times, stating: “In early August 2007 I received an anonymous missive. In this missive I was informed that Arthur Sulzberger Jr. had engaged in talks with his friend, Steven Rattner, to take The New York Times private.” I continued: “But most notably according to this informant these conversations mentioned that Sulzberger Jr. and Rattner had stated that this private equity deal should take place when the price of the stock of The New York Times was at $15 ….. Now that the stock price of The New York Times is hovering in the $16 range, I feel that I must notify you of this letter.”

The Times knew of the imminent stock slide and didn’t warn investors; the Times knew its business model was outdated; and, Sulzberger wanted to take the company private once the stock reached $15, which would be much cheaper than at $20. Several months later the Times announced that it had sought an investment from Bloomberg Corp. Rattner is advisor to Bloomberg. Ironically, now that the share is just over $4, no one is interested and Sulzberger can’t take the company private.

Later, I read in The Wall Street Journal that Harbert Management Corp. was purchasing an interest in The New York Times; the firm was seeking success where Elmasry had met failure. I decided to notify these new investors of the duplicity of The New York Times management, in a letter to Raymond T. Harbert, Chairman. Harbert Management was given two seats on the Board of The New York Times.

All this has not improved the Times’ fortunes. Now, given his failure to save his friend Sulzberger’s media company, would you entrust Rattner with the fortunes of the auto industry?

The past is prolog to the future.