[SBA COVID-19 Relief Loan Funding]

Velazquez: “To expand opportunities for women-, minority-, and veteran-owned businesses, we must increase the role of mission-based lenders, those who are deeply embedded in their communities, such as community banks, community development financial institutions, and SBA microloan intermediaries.”

Photo: YouTube

Today, House Small Business Committee Chairwoman Nydia M. Velázquez (D-NY) issued the following statement on the status of funding for the Paycheck Protection Program:

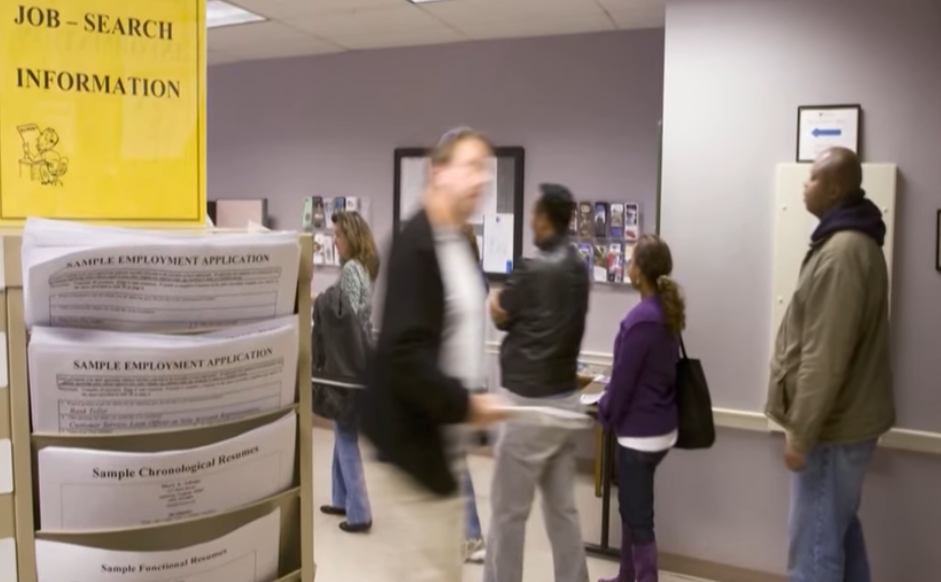

“The intent of the Paycheck Protection Program has always been to help Main Street businesses across America that are facing gut-wrenching decisions over payroll costs, rent bills, and the health and safety of their employees and customers.

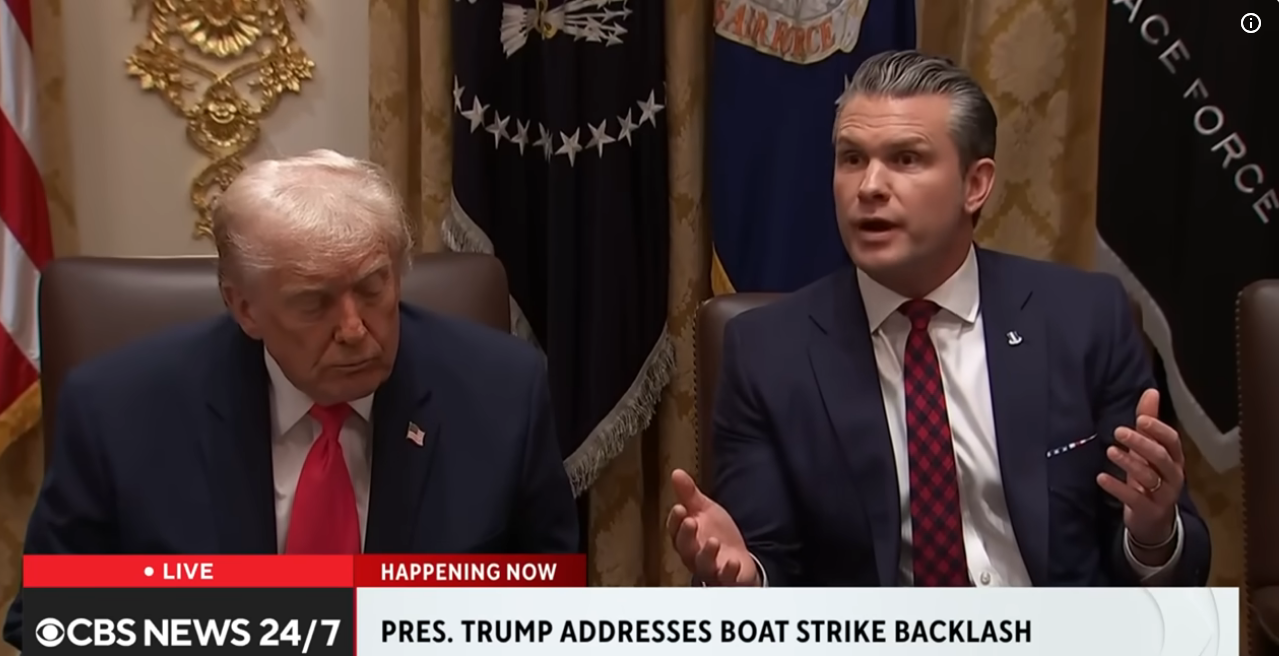

“Unfortunately, during the program’s rollout, we have seen one mismanagement after another from the Trump Administration. From a lack of clear guidance for lenders to reports of large corporations being awarded loans, we simply cannot continue to pour taxpayer money into federal programs without increasing guardrails, promoting transparency, and expanding opportunities for the most underserved small businesses.

“Right now, a lack of data over who is receiving these loans has left unanswered questions as to whether taxpayer funding is going to those the program was intended to serve. Before Congress allocates billions of additional dollars, the Administration must show a greater commitment to transparency.

“To expand opportunities for women, minority, and veteran-owned businesses, we must increase the role of mission-based lenders, those who are deeply embedded in their communities, such as community banks, community development financial institutions, and SBA microloan intermediaries. Specifically, by setting aside funding for these institutions, the program will be able to reach small businesses regardless of their prior banking status.

“Finally, we must adjust the program’s flexibility to meet the reality that under many stay-at-home orders, businesses are required to keep their doors shut. By making these reforms to the program’s rules, we can help businesses rehire after stay-at-home orders are lifted.

“This is a national crisis, and refueling the small business economy will only happen if we simultaneously dedicate robust resources to curbing the spread of coronavirus. That is why I am proud to support Speaker Pelosi’s call for additional funding for hospitals on the frontlines, state and local governments, and food assistance programs. It takes an all hands-on deck approach to defeat a crisis of this magnitude, and the federal government has a responsibility to be a vigorous force in all efforts.”