You don’t need money to make money.

Whether for the purpose of obtaining a business, starting a business or purchasing real estate, the subject of raising money always causes a buzz. As a former banker and current Mortgage Broker, I constantly witness mass interest in the subject, but so little information that is shared actually helps the majority of the participants.

The Truth about Raising Capital

“You don’t need money to make money�

Part 1 of 7

I have had the fortunate opportunity to participate in literally hundreds of panels on the subject of raising capital. Whether for the purpose of obtaining a business, starting a business or purchasing real estate, the subject of raising money always causes a buzz. As a former banker and current Mortgage Broker I constantly witness mass interest in the subject, but so little information that is shared actually helps the majority of the participants. The answers ranged from canned responses about building your credit, the Five C’s (The five key elements a borrower should have to obtain credit: character (integrity), capacity (sufficient cash flow to service the obligation, capital (net worth), collateral (assets to secure the debt), and conditions (of the borrower and the overall economy), to an oversimplification of angel investor and venture capital funding. Therefore, I sought out to gather information on strategies and formulas which could solve the fundamental issues faced by many Americans in general and the minority population in particular. My challenge was; how can I help people who were idea rich and cash poor, facing personal bankruptcy yet wanted to participate in the American dream or those who simply had too much month and not enough money. This column was initiated to serve as a resource for anyone who finds themselves or someone they know in such a situation. Over the next seven articles we will explore The Truth about Raising Capital.

No issue causes as much confusion as the subject of money. Money in of itself has and continues to cause the greatest amount of emotional misunderstanding.

Marriages are torn apart by it, business partners deceive one another for it, and people will kill others to possess it. Why so much confusion over this subject? What is the difference between it and capital? It dawned on me one night two years ago as I lay in the bed watching television. In that moment the answer came to me. The problem stems from something that I now refer to as the “The Cramdon Phenomena�. I based it on the fictional character Ralph Cramdon of the popular 50’s show The Honeymooners. For those of you (us) too young to remember, Ralph played by the late Jackie Gleason was a bus driver who would constantly devise get rich schemes in order to make his fortune. He was plagued by the oft sharp tongue and doubt of his wife Alice played by Audrey Meadows. Well, Ralph would always say it takes money to make money! I said Wow! This is why he (people) have such a hard time raising money/capital. Money and capital are not the same thing. Could it be that the people simply need a better understanding of what an asset is and who they are? This question led to some interesting conclusions that we will share with you. Ok, are you with me? Let me explain.

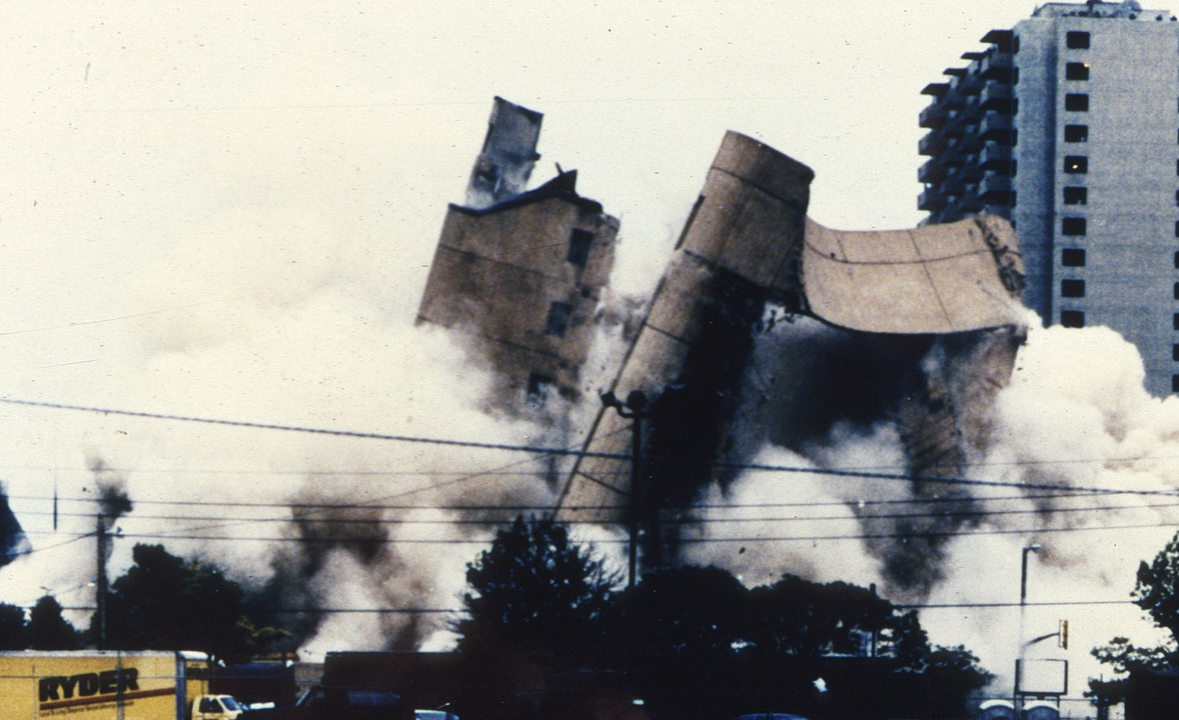

At first glance when many read the title we automatically, said to ourselves, “that can’t be true because everyone knows that it takes money to make money�.

Well by the time you finish taking this journey with us it is our fondest desire that any thoughts of that caliber meet their well deserved destruction.

Let’s talk about our response; we automatically assumed that capital and money is the same thing. I named part 1 “You don’t need money to make money� because you don’t. However, it does require capital. Confused? Great this means that you are thinking. As a young man my father always stated that “what causes immense chaos in life is people’s confusion between their definition of a word and its actual meaning, so everything that they think they understand only serves to confuse them more�. In order for you grasp this simple yet profound truth let us examine the meaning of three words: capital, money and assets.

Capital- assets available for use in the production of further assets

Money- A means of payment or a measure of value.

Assets- Items which hold commercial or exchange value.

Our new rule for this subject will be the following: assets are the capital which create money. At this point you may be saying I do not have any assets. That assumption would be incorrect. Due to the fact that most people avoid the subject of sales like the plague, when I mention the following treatment many of you will not listen. But ideas can be sold and developed without the need for your money. I want to go a step beyond the famous get rich seminar notions of OPM (Other People’s Money). Let us return to the definition of an asset; items which hold commercial or exchange value. Just because you have an idea that does not mean that it will be perceived as holding commercial value. The system that I utilize for asset development for my clients is based on a physics formula that is taught everyday in junior high school:

W=fd or Work is equal to force times distance.

An everyday application of this formula would be, let’s say I tell you that I want you to push on a wall in your living room for eight hours. You then proceed to do it and when I visit you at the end of the day I ask you the following question; How was work today? Your response would probably be it was hard but I couldn’t move the wall at all. Well even though you sweated and pushed diligently according to the formula you did no work, because the wall did not move. The formula for work identifies that unless you move forward with your energy or plan you receive no credit. You see this is why money is not capital. Money by definition is a means of payment for the utilization of our greatest assets which is Intellectual Capital.

Join us next time and learn: “How to turn your ideas into gold�.

Greg Jones is CEO of GJ Presents, Inc, Business Development Advisor and author of the book, The Art of Raising Capital.

He can be reached at [email protected]

Greg Jones’ CAPITAL INSIGHT is brought to you by Winning Strategies & Associates, LLC – Contact [email protected]

To subscribe to or advertise in New York’s leading Pan African weekly investigative newspaper please call (212) 481-7745 or send a note to [email protected]