[Housing News\Real Estate Speculation]

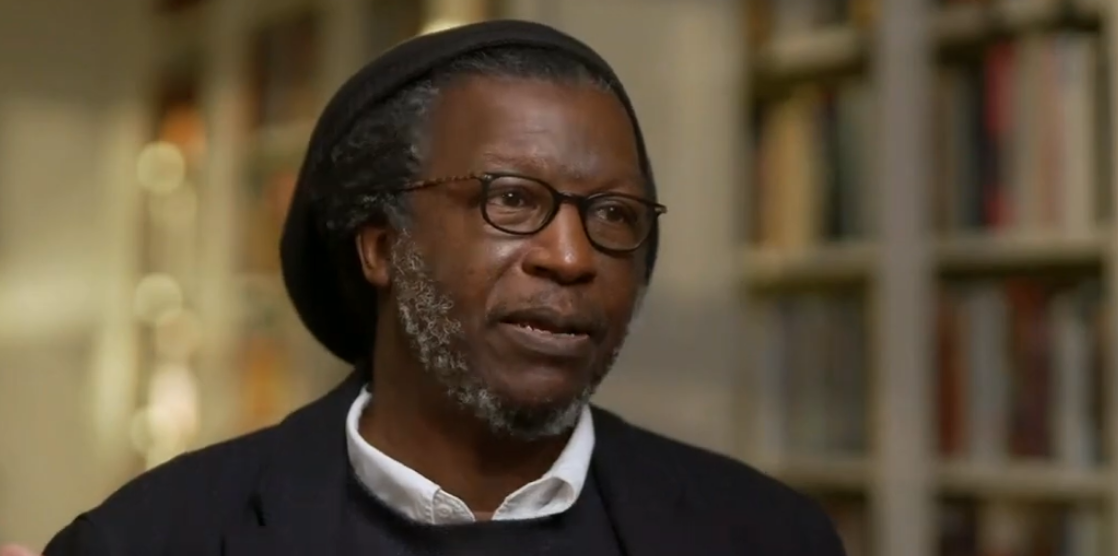

Senator Julia Salazar, of the 18th District in northern Brooklyn. “Real Estate speculations exploit small homeowners and tenants alike and without unity and solidarity, they will succeed in dividing us against each other and displacing our communities.”

Karen Haycox, CEO of Habitat for Humanity New York City: “It is time for Albany to address the significant barriers to becoming a first-time homebuyer, especially for low-to-moderate income families.”

Photo: Facebook

Assembly Members Alicia Hyndman and Erik Martin Dilan joined with homeowners and advocates on Tuesday, November 12, 2019, to call on the members of the New York State Assembly and Senate to support the “Homeowner Bill of Rights,” a set of principles essential to preserving homeownership for low- and moderate-income New Yorkers.

The “Homeowner Bill of Rights,” unveiled at Tuesday’s press conference, calls for legislation including the Small Home Anti-Speculation Tax (S3060/A5375), the Affordable Housing Corporation Reform Bill (S1824/A6277), and a bill to support Community Land Trusts (S3469/A5081).

“It is important for homeowners and tenants to work together, because this is a fight about preserving affordable housing,” said Senator Julia Salazar, of the 18th District in northern Brooklyn. “Real Estate speculations exploit small homeowners and tenants alike and without unity and solidarity, they will succeed in dividing us against each other and displacing our communities.”

The lawmaker is one of the main supporters of state legislation that would curb real estate speculation of homes that would otherwise be sold to low- and moderate-income New Yorkers by imposing an additional tax on properties bought and resold within 1 or 2 years. Neighborhoods throughout the city that suffered from decades of reinvestment are now seeing excessive increases in property prices and an explosion of real estate speculation. The more valuable these neighborhoods become, the more their residents — who invested in and supported their communities when no one else did — are exposed to harassment and threatened by displacement.

“As a homeowner myself, I know how valuable it is to put down roots in a neighborhood. Unfortunately, not everyone thinks that way – and at times, unscrupulous actors have resorted to fraudulent measures that have displaced families and exacerbated our affordable housing crisis,” said Brooklyn Borough President Eric L. Adams. “It’s time we implement legislative solutions to a crisis that has gripped the borough. I applaud the advocates and my partners in government for taking aggressive steps to end rampant speculation in disinvested neighborhoods throughout Brooklyn, and give more people of color an opportunity to be homeowners.”

The “Homeowner Bill of Rights” highlights the importance of homeownership — a critical source of naturally occurring affordable rental units, and financial stability, as well as the largest asset-building opportunity for many working New Yorkers. Yet tens of thousands of families are at risk of losing their homes to foreclosure, scams, and tax liens. In 2017, 40,000 NYC families were in danger of foreclosure, and foreclosure auctions were at their highest rate since 2006.

“After 53 years living in my home, I feel investors are trying to push me out,” said Onelia Torres, a homeowner in East New York, Brooklyn. “I don’t plan to leave my area, my kids were raised and educated here. I have a lot of memories. I don’t feel that I should be pushed out of here. This is my community. Investors and real estate agents have been following me, pressuring me to sell my property.”

People of color are particularly at risk of losing out on the benefits of affordable homeownership. Historical obstacles like redlining and lack of access to safe mortgage financing prevent communities of color from benefiting from homeownership to the extent that white households do.

Black and Hispanic households make up 45% of households in the city, but just 30% of the city’s homeowners. The difference in homeownership rates is a critical driver of the racial wealth gap and an immense obstacle to a more equitable NYC: 45% of families of color have zero or negative net worth compared to only 23% of white families.

“More has to be done now to protect New York’s low-income and vulnerable homeowners from displacement and to promote affordable homeownership,” said Rachel Fee, Executive Director of the New York Housing Conference. “New York Housing Conference is a proud member of the Coalition for Affordable Homes and we are asking our elected officials to fight for vulnerable homeowners and provide sufficient resources to support the creation of more affordable homeownership opportunities across the state.”

“We want real people to own homes, not investors,” said Christie Peale, Executive Director of the Center for NYC Neighborhoods. “Our vision is of a City where homeownership is a truly viable choice for working New Yorkers and not only the wealthy.”

“It is time for Albany to address the significant barriers to becoming a first-time homebuyer, especially for low-to-moderate income families,” said Karen Haycox, CEO of Habitat for Humanity New York City. “The long-neglected affordable ownership sector of the housing continuum would be substantially addressed by passing a Housing Bill of Rights package aimed at supporting existing affordable homes, as well as the creation of new, permanently affordable, first-time homebuyer opportunities for low-to-moderate-income families.”

“As in 2008, the threat of foreclosure continues to be the greatest challenge for many homeowners today. Housing counseling and direct legal support will ensure safe, affordable, and decent housing for underserved residents,” said Angella Davidson, Program Director at NHS of Brooklyn. “We urge our legislators to fund housing counseling and legal service provides to assist homeowners combating foreclosure.”

“We are seeing many homes being sold at auction in the communities we serve in Southeast Queens. One property in Cambria Heights was purchased at a foreclosure auction in 2019 by an LLC for $375,000 and sold to a family six months later for $605,000 with an FHA mortgage,” said Lori Miller, Executive Director of NHS of Jamaica. “The LLC made a 61% profit on its investment. Investors are inflating the values of homes in our communities and making it either impossible for people to purchase a home or burdens them with very expensive mortgages to become homeowners.”

About the Coalition for Affordable Homes

The Coalition for Affordable Homes is made up of 28 housing non-profits, community associations, local development corporations, and legal services agencies that have seen the struggles communities face firsthand. Neighborhoods from Jamaica, Queens, to Wakefield in the Bronx–long-time bastions of middle- and working-class homeowners–have faced continued challenges over the past decade: predatory lending, speculators and investors, and skyrocketing housing costs that displace families from neighborhoods they’ve called home for decades.

About the Coalition for Community Advancement

The Coalition for Community Advancement was founded in 2015 to give East New York residents a voice in the rezoning of the area. Through their advocacy and work with local politicians, they successfully advocated for major changes to the rezoning and helped open a jobs center, as well as securing other benefits for the area.