[Wells Fargo Accountability]

Rep. Waters: “Over the past decade, Wells Fargo’s board, management, and regulators have all failed to fix the company’s internal control weaknesses that caused enormous harm for millions of consumers throughout the country.”

Photo: YouTube

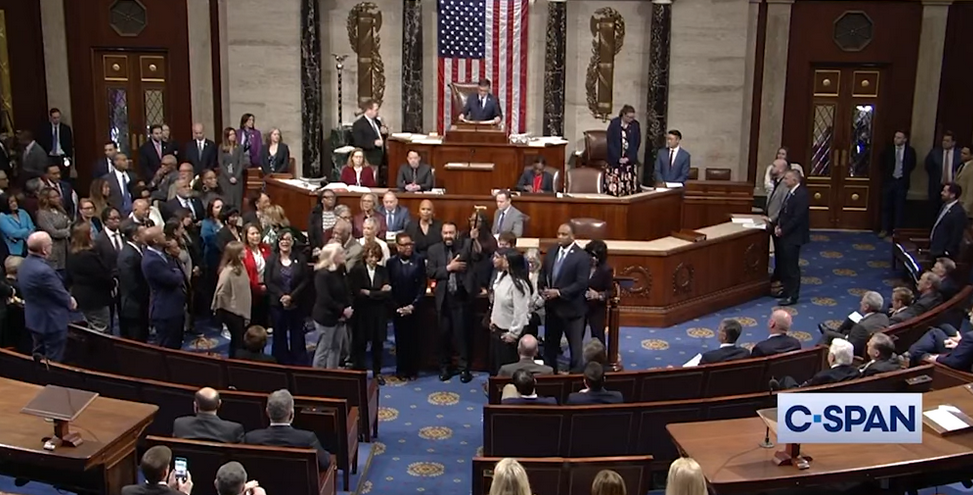

California Congresswoman Maxine Waters is doing her best to hold Wells Fargo accountable for their crimes against American consumers.

Today, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, delivered the following opening statement at a full Committee hearing entitled, “Holding Wells Fargo Accountable: Examining the Role of the Board of Directors in the Bank’s Egregious Pattern of Consumer Abuses.”

The following are Congresswoman Waters’ remarks.

“Today, we receive testimony from Elizabeth Duke and James Quigley, who until earlier this week served as chair of the board of directors of Wells Fargo & Company and Wells Fargo Bank, respectively. Both resigned after I called for their resignations following the release of a scathing Majority staff report on Wells Fargo’s compliance failures and their individual failures as board chairs.

“But their resignations do not absolve them of their failures. Directors at Wells Fargo and institutions across this country must understand that they are the last line of defense when it comes to protecting their companies’ shareholders, employees, and customers. And while Ms. Duke and Mr. Quigley said they resigned to ‘avoid distraction,’ let me be clear that this is not a distraction—we are examining misconduct and dereliction of duty.

“Over the past decade, Wells Fargo’s board, management, and regulators have all failed to fix the company’s internal control weaknesses that caused enormous harm for millions of consumers throughout the country.

“The Majority staff’s report examined Wells Fargo’s compliance with five consent orders that required the company’s board and management to clean up the systemic weaknesses that led to widespread consumer abuses and compliance breakdowns. As board members, Ms. Duke and Mr. Quigley were responsible for ensuring that Wells Fargo’s CEO and other management executed an effective program to manage those risks. However, the Majority staff report found that Wells Fargo’s board:

(1) Failed to ensure management could competently address the risk management deficiencies;

(2) Allowed management to repeatedly submit materially deficient plans to address consumer abuses;

(3) Prioritized financial considerations over fixing consumer abuses; and,

(4) Did not hold senior management accountable for repeated failures.

“The Majority staff report also revealed attitudes and failures on the part of Ms. Duke and Mr. Quigley that are dismaying.

“When the Consumer Financial Protection Bureau included Ms. Duke on letters requesting actions from the bank, she responded asking, ‘Why are you sending it to me, the board, rather than the department manager?’ This was surprising to CFPB officials, and gives the appearance of a see-no-evil mentality from Ms. Duke, and an unwillingness to exercise oversight required of her as a member of the board.

“Mr. Quigley also did not appear to understand the gravity of his board responsibilities. When the Office of the Comptroller of the Currency wanted to schedule a meeting with the bank’s directors to discuss ‘progress and accountability,’ Mr. Quigley told other bank officials that he was, ‘currently scheduled to be in the Galapagos Islands on these dates,’ and commented that ‘the sense of urgency is surprising…’

“These statements were made after several public enforcement actions against Wells Fargo for massive consumer abuse scandals.

“While Ms. Duke and Mr. Quigley have resigned, they must be held accountable for the dereliction of their duties as members of Wells Fargo’s board.